Any forward looking estimates presented by Quantalytics may prove to be incorrect and not be realized. All investments and investment recommendations entail risks. Such data, information, or opinions are not an offer to sell or to buy, or a solicitation to buy or sell any securities.

Any data, information, or opinions presented by Quantalytics are for general information purposes only. Quantalytics is not a registered investment adviser, brokerage firm, or investment company.

Q.ai, LLC is a wholly owned subsidiary of Quantalytics Holdings, LLC (“Quantalytics”). approved the sale of the Canadian-based firm and may have opened the door for more aggressive bidding by China's big state-backed oil firms.Ĭhesapeake's shares are trading up about 1.5% in premarket activity this morning, at $20.80 in a 52-week range of $13.32 to $26.09.įiled under: 24/7 Wall St.Q.ai is the trade name of Quantalytics Holdings, LLC. producer - not necessarily Chesapeake, of course - as a result of the recently approved $15 billion acquisition of Nexen Inc. The interesting thing that could develop from this is a sale of a U.S. Chesapeake reported production from the play of 32,500 barrels of oil equivalent per day at the end of December. If the deal with Chesapeake follows the established pattern, Sinopec will pay some portion of the purchase price in cash and the remainder will be used to develop new wells in the Mississippi Lime play. (NYSE: DVN) last January for a one-third interest in five of Devon's shale plays.Ĭhesapeake already has sold more than $3 billion in assets to China's CNOOC Ltd.

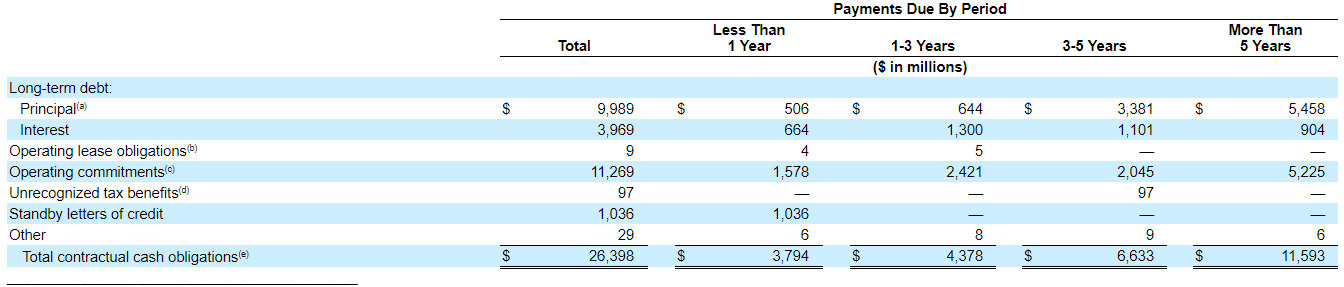

Sinopec paid about $2.2 billion to Devon Energy Corp. (NYSE: SNP) - said that Asia's largest oil refiner will acquire 50% of Chesapeake's oil and gas properties in the Mississippi Lime formation that straddles the Oklahoma-Kansas border for $1.02 billion. Reuters reports this morning that a source at Sinopec - China Petroleum & Chemical Corp. The sell-off for the new year is just getting started, and it has rolled out with a bang. (NYSE: CHK) parted with about $13 billion in assets last year in an effort to reduce the company's massive debt burden.

0 kommentar(er)

0 kommentar(er)